Taxation (General)

- View details

Tax Digest Issue 280 Finance Bill 2026 February 2026

ISBN: Z000051030290Publication Date: February 2026This Digest covers the Finance Bill 2026 which was published after the Budget on 26 November 2025. It provides detailed, expert guidance including: overall analysis of the Finance Bill provisions published following the recent Budget; measures relating to income tax, capital gains tax and corporate tax; and changes relating to compliance with impacts for tax advisers.

£ 70.00 - View details

Tax Digest Issue 273 July 2025

ISBN: Z000050990320Publication Date: July 2025This provides detailed, expert guidance including: the UK statutory residence test; foreign income and gains rules; CGT rebasing for former remittance basis users; temporary repatriation facility; and much more.

£ 70.00 - View details

Tax Digest Issue 272 June 2025

ISBN: Z000050990312Publication Date: June 2025This Digest covers the origins of the PPR legislation and why it is so complex; a detailed analysis of the legislation and its contentious points.

£ 70.00 - View details

Tax Digest Issue 267 January 2025 - Finance Bill 2025

ISBN: Z000050990266Publication Date: January 2025This digest covers detailed, expert guidance including: overall analysis of the Finance Bill provisions published following the recent Budget

£ 70.00 - View details

Tax Digest Issue 259 May 2024

ISBN: Z000050964672Publication Date: May 2024This Digest covers important topics relevant to withholding tax which is a mechanism by which tax authorities collect tax.

£ 70.00 - View details

Tax Adviser Subscription

ISBN: Z000050488374Publication Date: January 2011Tax Adviser is the official journal of the Chartered Institute of Taxation and the Association of Taxation Technicians.

£ 194.00View detailsTolley's Tax Digest

ISBN: 9780754527190Publication Date: March 2004Each month you'll receive a digest giving advice on a separate topic packed with practical guidance and worked examples. Over the year, these build into a comprehensive reference source, right there on your bookshelf.

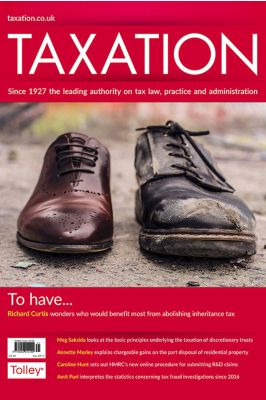

£ 702.00View detailsTaxation Magazine

ISBN: 00400149Publication Date: October 1992Taxation Magazine weekly round-up of the latest tax news and its impact on your clients.

£ 704.00View detailsThe Tax Journal

ISBN: 09547274Publication Date: August 1989Tax Journal provides cutting edge insight – for tax experts by tax experts

£ 879.00