Redefining client value: Caribbean law firms pivot to meet shifting client needs

Caribbean attorneys are rethinking what value means and how best to deliver it.

More than half (51%) of attorneys say client expectations have risen over the past 12 months. Firms are responding by reviewing information sources, adopting automation, and testing new billing models.

"Regionally and here in The Bahamas, lawyers are focused on delivering greater value, increasing capacity, and improving optimisation and client outcomes amid rising costs, regulatory pressures, and rapid technological change.

The report highlights not only the swift uptake of AI, but a growing recognition that trusted, authoritative sources must remain the foundation of legal work in an era of rapid research and automation.

As recent jurisprudence around the region has demonstrated, gaps in readiness and concerns about due diligence, inaccuracy, and confidentiality cannot be ignored. Bar Associations across the Caribbean must therefore provide principled practical guidance and support, reinforce professional standards, and ensure that innovation strengthens rather than undermines the trust on which our justice systems rely."

The new client standard

Client expectations continue to skyrocket in the Caribbean. But attorneys are responding with sensible solutions.

Clients' expectations are evolving at pace, and firms are under pressure to modernise how they operate and how they deliver value.

Just over half (51%) of Caribbean attorneys say client demands have grown over the past year, our latest survey found.

Half of Caribbean attorneys say client demands have grown over the past year

Technology is changing how clients perceive value, a partner at a medium-sized firm told us.

"Clients expect faster, more cost-effective service while still demanding accuracy and strategic insight."

The emphasis is now on an attorney's judgment, creativity, and ability to apply insights to complex, human-centered legal decisions, she says.

An associate at a large firm told us: "Speed is now something clients expect as a baseline, rather than something you pay as an add-on."

Despite this, attorneys continue to hold fast to their professional standards, with 82% revealing they always prioritise quality over speed.

However, many are under the pump to streamline operations. Nearly half (46%) admit they spend too much time drafting or updating legal documents, while the majority struggle to find a balance between prioritising new and existing clients.

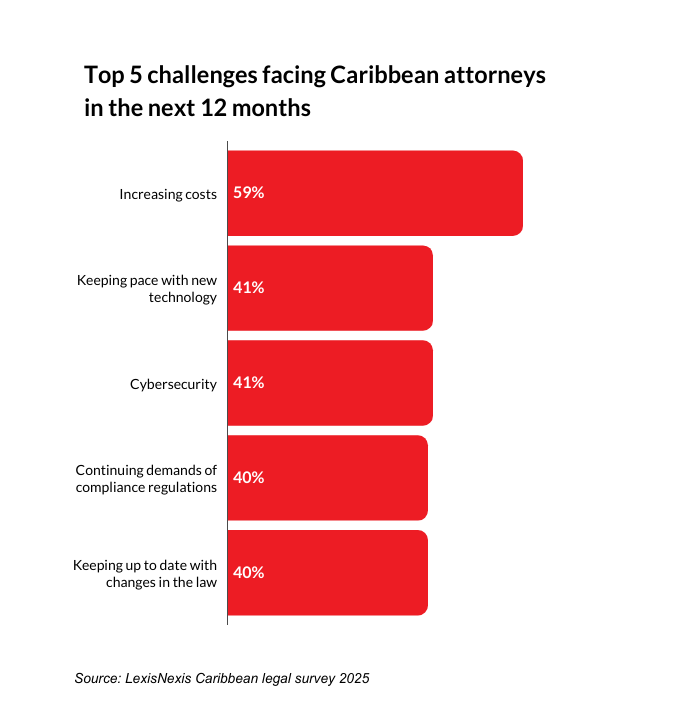

Rising costs was listed as the biggest challenge legal teams are up against right now (59%).

Close behind are the challenges created by the rapid pace of technological change and growing cybersecurity threats, each cited by 41% of respondents. Regulatory complexity also remains a constant strain, with 40% struggling to stay on top of shifting compliance demands and updates to the law.

How law firms are responding to a challenging legal market

The 2023 Caribbean legal market showed a profession eager to accelerate out of the post-lockdown era, driven by a strong appetite for growth.

Two years later and that ambition remains, but the focus has shifted. Firms are now concentrating on innovation, agility and delivering greater client value.

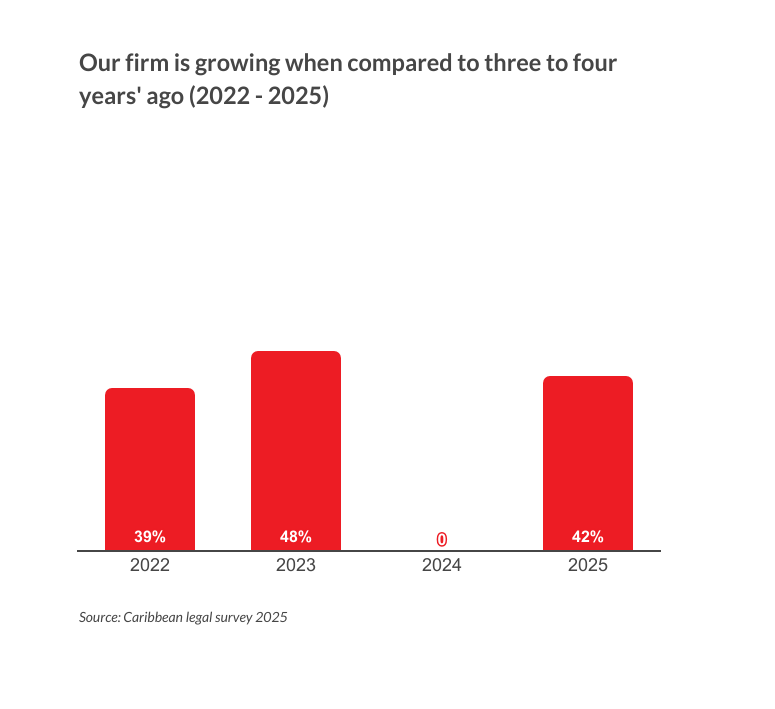

Our 2025 survey shows that 42% of attorneys believe their firm is growing compared with three to four years ago, a slight softening from 48% in 2023, but still a positive outlook overall. Only 3% say their firm is in decline, consistent with the gradual improvement seen since 6% in 2022.

42% of Caribbean attorneys say their law firm has grown

Growth strategies themselves are becoming more deliberate. The overwhelming majority of firms plan to expand organically, rather than through mergers or acquisitions (M&A). Just 2% intend to grow via M&A alone, the same level recorded in 2023, and far below the 14% reported in 2022.

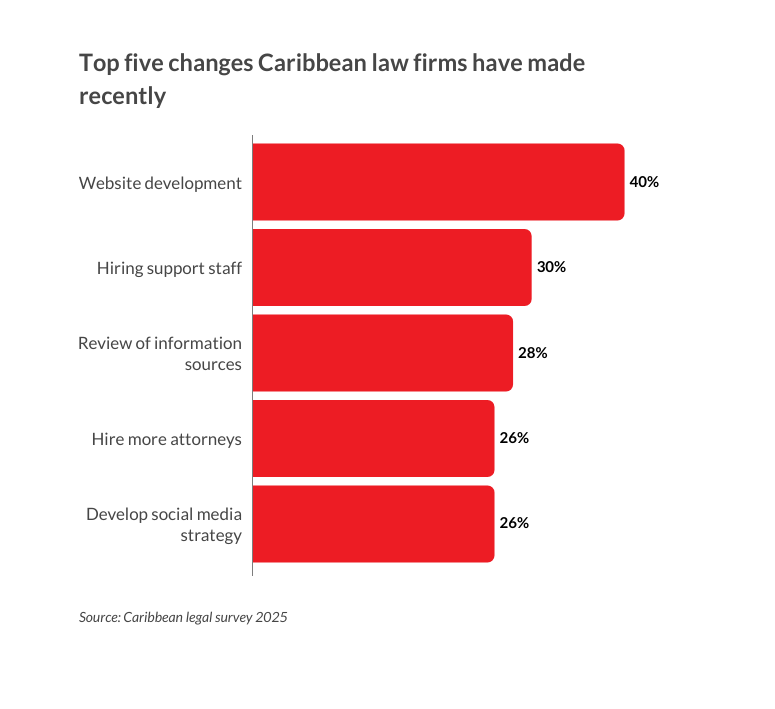

When asked where growth is already taking shape, firms pointed to practical improvements such as website development (40%), hiring support staff (30%), and a review of information sources (28%).

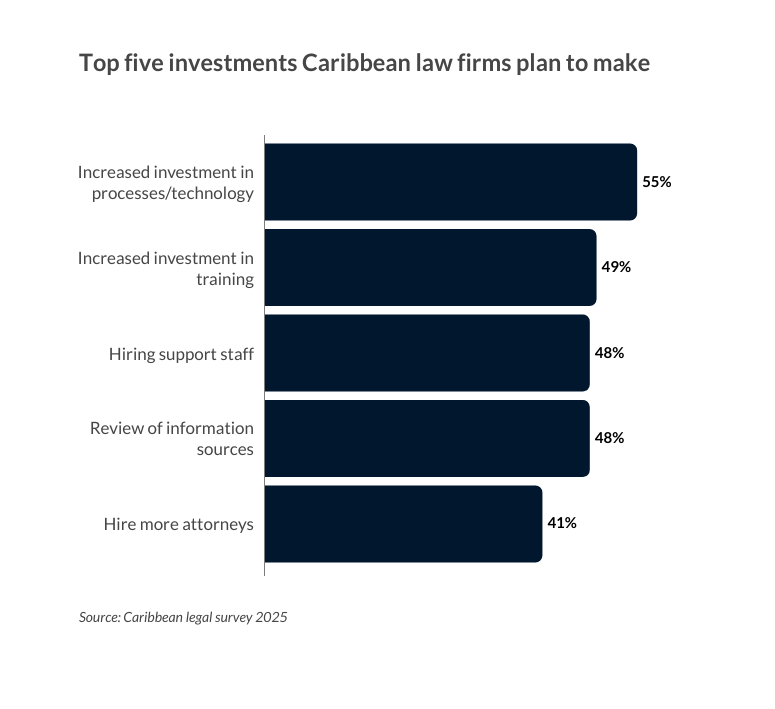

Looking ahead, investment priorities become even clearer.

- 55% plan to increase spending on processes and technology, up from 49% in 2023

- 49% plan to invest in training

- 48% intend to hire additional support staff

- 48% say they will conduct a review of their information sources.

Attorneys remain committed to quality, but many acknowledge significant efficiency gaps and rising operational pressures. With costs, technology change, and regulatory complexity reshaping expectations, firms are increasingly turning to innovation and smarter resource allocation to maintain value while meeting escalating client demands.

Caribbean attorneys go all-in on AI

An overwhelming four-fifths of Caribbean attorneys are using AI for legal work.

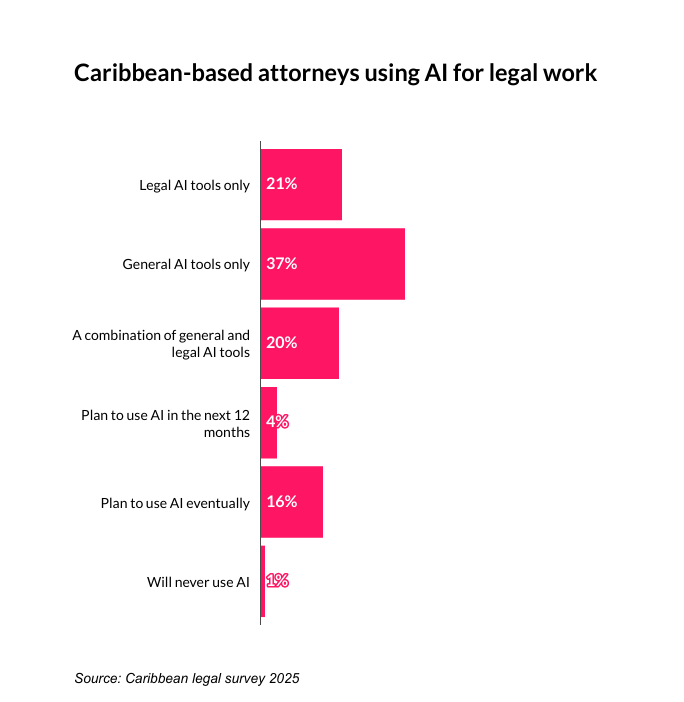

Generative AI has already reached a tipping point in the Caribbean legal market. Nearly eight in ten attorneys (78%) say they are using AI tools in some capacity, signalling one of the fastest rates of early adoption anywhere in the global profession.

Four-fifths of Caribbean attorneys are using AI

Around half are turning specifically to legal-grade AI tools such as Lexis+ AI, while the remainder are experimenting with more general-purpose platforms.

Resistance is almost non-existent. Just 1% of respondents say they will never invest in AI.

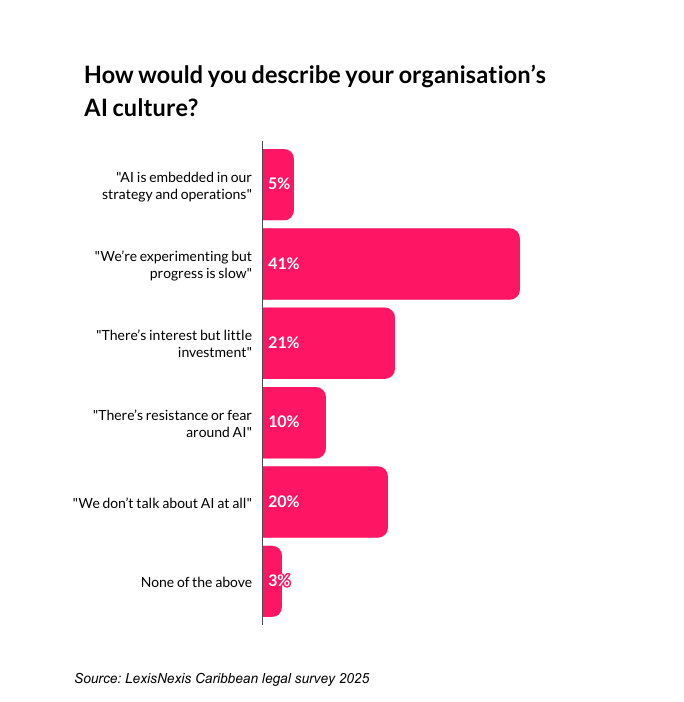

Yet widespread use does not mean widespread maturity. Only 5% report that AI is genuinely embedded in their organisation’s strategy and operations. A larger group (41%) are investing but admit that progress is slow. Perhaps most concerning: one in five attorneys (20%) say their organisation simply does not talk about AI at all, a silence that risks putting firms on the back foot as client expectations rise.

Another associate at a small firm told us:

"It makes me even more efficient by cutting the amount of time spent on certain matters including administrative matters."

As AI automates research and drafting, clients will expect faster, more cost-effective service while still demanding accuracy and strategic insight, they said.

"This will place greater emphasis on a lawyer’s judgment, creativity, and ability to apply AI insights to complex, human-centred legal decisions."

Caribbean attorneys are also clear-eyed about the risks.

- 70% worry about inaccurate or fabricated AI outputs (hallucinations)

- 53% fear becoming overly-dependent on AI

- 51% are concerned about leaking confidential information.

Trust, therefore, is emerging as the deciding factor. Three-quarters (75%) say they feel more comfortable using AI that is grounded in trusted legal sources, an important signal for vendors and firm leaders alike.

AI readiness is also becoming a career issue.

- 16% of attorneys would consider leaving their organisation if it failed to embrace AI

- One-third (33%) believe a lack of AI adoption would negatively impact their long-term career prospects.

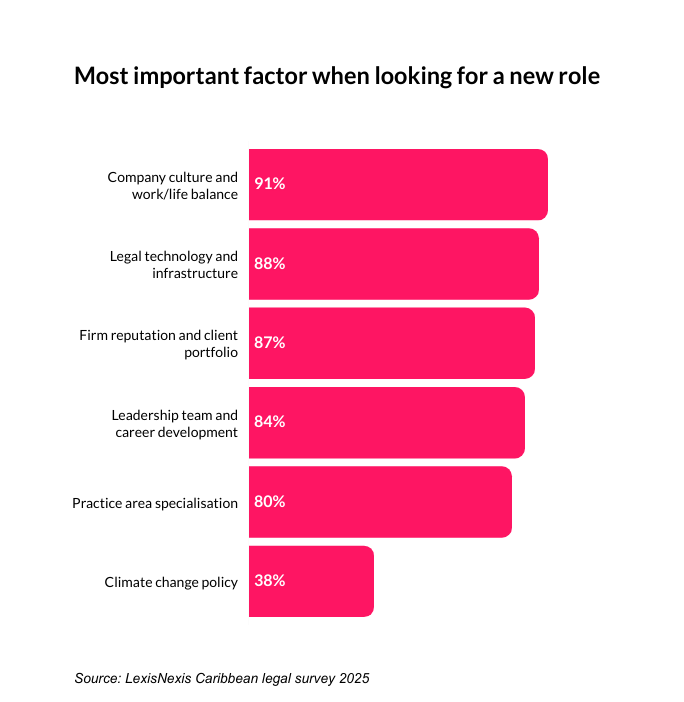

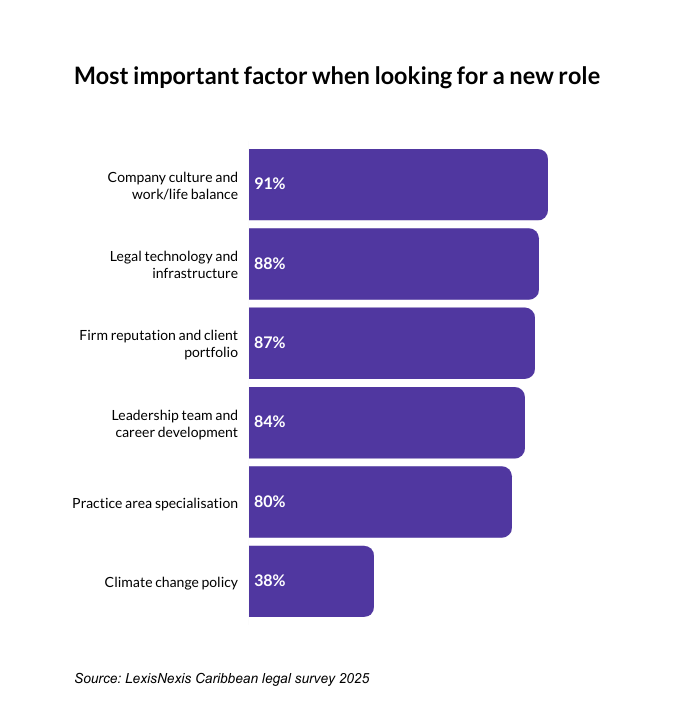

When respondents were asked which factors matter most in shaping their decisions, company culture and work-life balance emerged as the strongest priority, with 91% selecting it. This was followed closely by legal technology and infrastructure (88%) and firm reputation and client portfolio (87%), highlighting the importance of both workplace environment and operational capability.

Leadership also plays a major role, with 84% valuing the leadership team and career development opportunities available to them.

Practice area specialisation sits just behind at 80%, reflecting the continued appeal of roles that allow individuals to build deeper expertise.

Attorneys see clear efficiency gains in AI but remain cautious about accuracy, confidentiality, and overreliance. As client expectations accelerate, firms that invest in trusted, legal-grade AI tools will be best placed to compete.

Reviewing what information attorneys rely on

Trusted authoritative legal sources are now more important than ever.

Out of all the changes firms have made in the last year, the reviewing of legal information sources is one of the most common.

Almost a third of attorneys said they have reviewed their information sources (28%) recently, making it the third biggest recent change. In addition, half (48%) plan to follow suit shortly, fast becoming the next major step in modernising legal research.

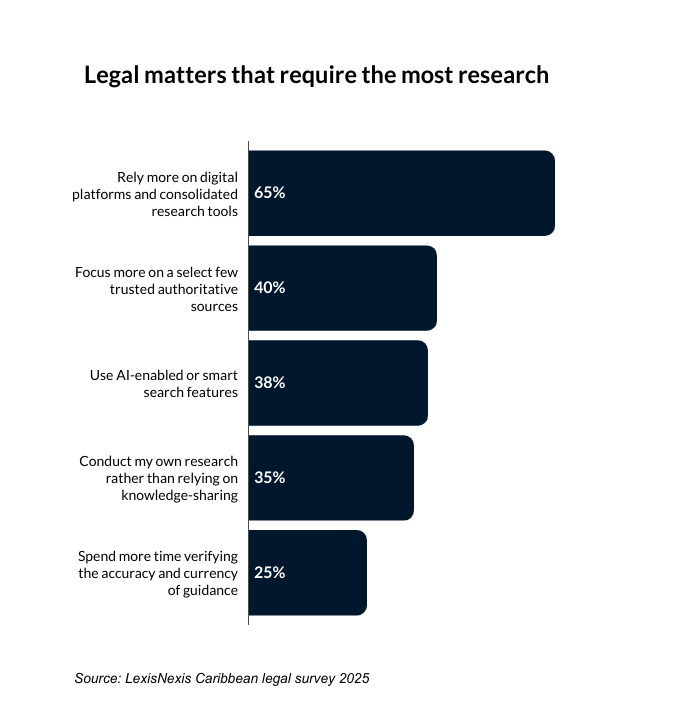

Nearly two-thirds (65%) now rely more heavily on digital platforms and consolidated research tools than they did three years ago, reflecting a shift towards efficiency and trusted, centralised information.

Two-thirds rely more heavily on digital platforms and consolidated research tools.

A further 40% say they increasingly focus on a small number of authoritative sources, while 38% are turning to AI-enabled or smart search tools to surface information faster. Verification behaviours are also tightening, with a quarter spending more time checking accuracy and currency.

Reliable legal sources are now more important than ever says Ramón Raveneau, Attorney at Law and President of the Bar Association of Saint Lucia.

"Saint Lucia, like many other jurisdictions within the Caribbean, is experiencing a profound shift in how legal professionals research, analyse and deliver guidance as generative AI becomes more prevalent, reinforcing the need for unwavering reliance on trusted, authoritative legal sources."

An in-house attorney in the public sector told us:

"AI It is cutting back on the time spent on matters, providing efficient answers and pooling resources together."

Generative AI has significantly streamlined legal research, a small law firm partner told us. "By rapidly summarising large volumes of case law, statutes, and precedent, lawyers can focus on analysis rather than data gathering."

They continued: "It also enhances legal guidance by generating well-structured drafts of arguments, pleadings, and contracts tailored to specific fact patterns or jurisdictions."

An associate at a medium-sized firm expressed a desire for AI to save significant time on the drafting process:

"I expect I will soon use AI to do the first draft. Now I’m relying on previous files I or my firm have worked on."

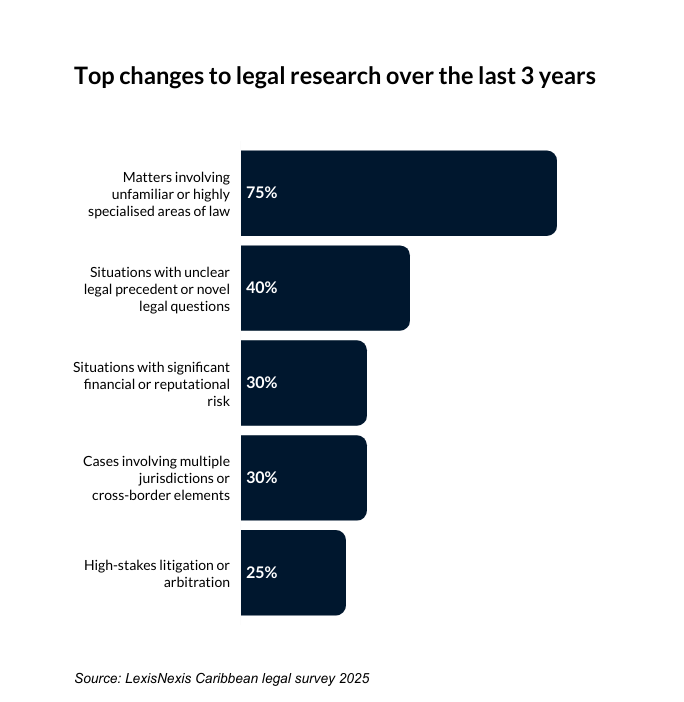

Confidence varies sharply depending on the nature of the matter. Lawyers feel least equipped when dealing with unfamiliar or highly specialised areas of law (75%), followed by work involving novel legal questions (40%). Issues carrying financial or reputational risk (30%) or involving multiple jurisdictions (30%) also raise uncertainty. High-stakes disputes and urgent matters rank lower, but still represent meaningful challenges.

Caribbean firms are rethinking where they get their legal information, turning to digital platforms and trusted sources that make research faster and easier. AI is helping lawyers spend less time hunting for details and more time on real analysis. But when matters are unfamiliar or high-stakes, the need for reliable, up-to-date, jurisdiction-specific information is still essential.

The changing economics of legal services

Could AI change law firm pricing models?

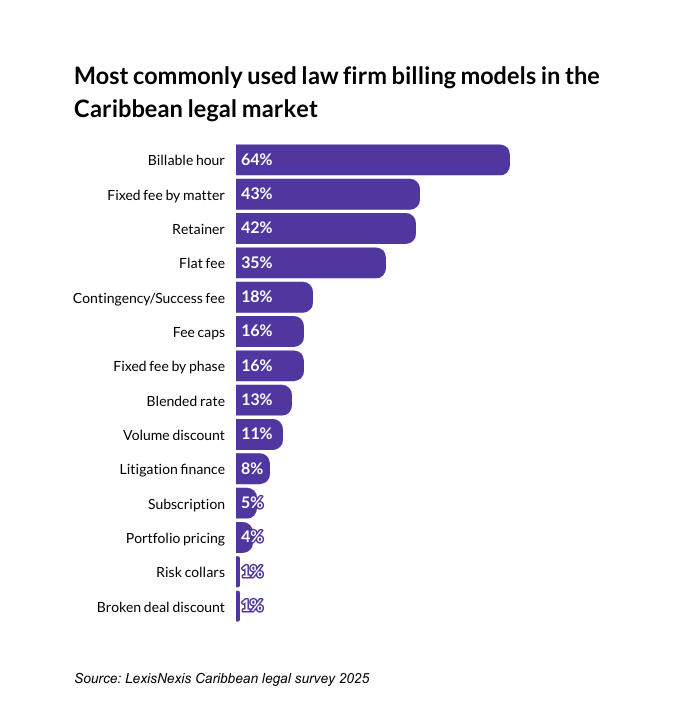

When asked which pricing models they are currently using, respondents overwhelmingly pointed to the billable hour (64%), underscoring its continued dominance across the legal sector.

However, a significant proportion are now adopting alternative fee arrangements that offer greater predictability and transparency for clients.

The most common alternatives include fixed fees by matter (43%), retainers (42%), and flat fees (35%), each signalling a shift toward cost certainty in areas where scope and complexity are more easily defined. More performance-linked approaches, such as contingency or success fees (18%), are used by a smaller segment, while fee caps and fixed fees by phase (both 16%) suggest targeted experimentation with hybrid models.

Less widely used options, including blended rates (13%), volume discounts (11%), and subscription pricing (5%), highlight the diversity of emerging models, though uptake remains limited. The very low incidence of portfolio pricing (4%), risk collars (1%), and broken deal discounts (1%) shows that more sophisticated commercial arrangements are still the exception rather than the rule.

Overall, the findings point to a market that recognises the need for pricing innovation, but still defaults to the structures it knows best, even as client expectations continue to evolve.

A third (34%) believe AI will change how law firms bill for their services, another shift that could reshape how legal work is scoped, priced and delivered across the region.

As clients grow more aware of technology’s capabilities, the profession must redefine value not by hours expended but by the quality, insight and ethical rigour we bring to every matter, says Raveneau.

"To navigate this transition effectively, our legal community must embrace a cultural and operational evolution that pairs technological adoption with continuous learning, strong professional standards and responsible governance."

AI should have a significant impact on most billing models and the overall scale of legal fees, one attorney told us.

At the moment pricing models are heavily determined by operational costs, said another attorney.

"I don't think AI will impact existing pricing models in the short-term, perhaps in the long-term when we see how it impacts the wider legal industry."

Raveneau believes AI will also continue to reshape cost structures, and it is important that we thoughtfully explore alternative pricing models that reflect transparency, efficiency and fairness.

"Our role at the Bar Association is to lead this transition with clarity and principle, ensuring that innovation strengthens, rather than disrupts, the integrity and accessibility of justice in St Lucia."

While AI has the capacity to speed up some processes, they believe it's still fallible and requires human input to safeguard against inaccuracies and improper applications.

While the billable hour still dominates in the Caribbean, firms are increasingly experimenting with alternative pricing models that offer greater predictability and transparency.

Overall, many attorneys believe AI will further reshape legal pricing by increasing efficiency and reducing cost-to-serve, though most expect change to be gradual.

Caribbean law firms are navigating a market defined by higher client expectations, rising costs, and rapid technological change. While quality remains non-negotiable, the pressure to deliver faster, smarter, and more cost-effective services is reshaping how firms operate. Those that invest in technology, skills, and streamlined processes will be best placed to protect margins, strengthen client relationships, and sustain growth in an increasingly competitive legal landscape.

Survey methodology

This survey took place in November and December of 2025. It included 91 participants from across the Caribbean legal market.