Bellwether Report 2025

Marginal gains: The hidden levers of growth

Minor but meaningful moves make all the difference for small and medium sized law firms.

Traditional law firm models aren’t broken. But they do need tuning – regularly, and with purpose.

Rising overheads and intensifying client expectations have pushed many small law firms into a state of uncertainty, prompting serious reflection about their long-term viability.

But the solution may not lie in sweeping reinvention or dramatic transformation. Instead, it's the small, strategic adjustments - the marginal gains - that are quietly proving to be the most effective antidote to shrinking profit margins.

The Bellwether 2025

In this annual Bellwether report we shift our focus away from big-picture overhauls and towards the minor, but meaningful, moves small and medium-sized firms are making to protect their future.

Growth is happening. But it's carefully controlled.

Small firms aren’t standing still. They’re just choosing smarter ways to move forward.

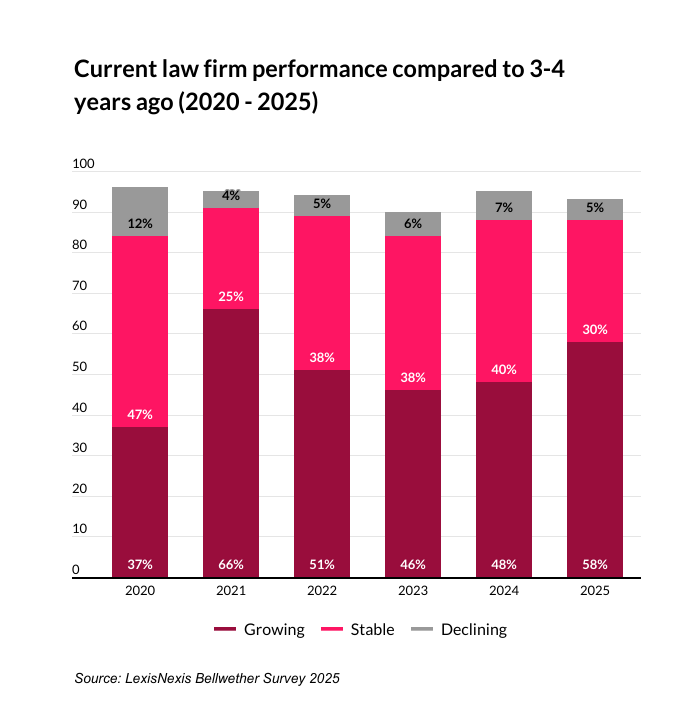

Despite economic uncertainty, there are strong signs of resilience among small firms. Nearly six in ten (58%) of respondents reported that their firm has grown compared to three or four years ago, up from 48% in 2024. Only 5% said their performance was declining, a notable improvement from 7% last year.

Nearly six in 10 said their law firm has grown since three to four years ago

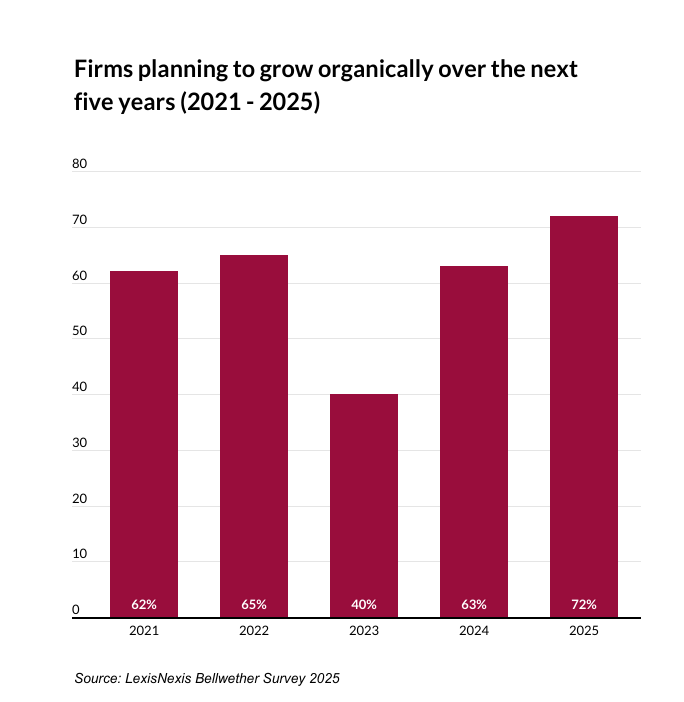

This growth is being achieved cautiously. An overwhelming 72% of firms now plan to expand organically, a sharp rise from 63% in 2024 and just 40% in 2023.

"Firms are looking for full control over their scale of operations, hinting at a careful rebalancing rather than a race for size," says Tim Rayner, Small Law Market Lead at LexisNexis UK.

Three-quarters said their firm plans to grow organically

Organic growth gives firms greater control, cultural cohesion and agility, says Kate Bennett, Co-founder and Partner of Arbor Law.

"This often matters more than scale alone in a market where clients value the quality of legal support and responsiveness over sheer size."

Bennett believes the firms that grow thoughtfully and retain cultural cohesion are better placed to build long-term enterprise value, particularly with rising investor interest in legal services.

"Organic growth is not only safer but also strategic for firms looking to differentiate now and maximise future flexibility."

Zoë Bloom, a Partner at family law firm AFP Bloom, says:

"The amount of strategic thinking and effort that is necessary to successfully merge two firms cannot be underplayed."

The real work comes when combining two different workplaces, management structures and leadership styles, says Bloom.

"So while a successful merger will create fast growth, organic growth can be softer, more malleable and in tune with staff needs."

Appetite for mergers and acquisitions has plummeted, with only 5% considering M&A as a growth strategy. This is down from 10% in 2024 and 13% in 2023. Financial risk (53%) was the most common reason cited for this reluctance, echoing broader concerns about overhead pressures and market instability.

Ben Giaretta, commercial disputes lawyer and Partner at Fox Williams, says mergers are an exceptional, not a normal, path to growth for law firms.

"Over the last decade many firms have been driven to merge by a desire to 'keep up with the Joneses'."

"But with fewer high-profile mergers hitting the press, firms have reverted to their tried and trusted strategies for growth."

Available cash is also probably a deciding factor, says Giaretta, with firms having less cash available because of AI technology investments and the recent HMRC taxation changes.

"Even if there are long-term benefits, mergers are expensive in the short term, as a result of advisers’ fees, redundancy payments etc."

Firms are proving that growth doesn’t have to mean taking big risks. Steady, focused expansion is clearly paying off.

Investment is targeted and cautiously optimistic

The firms making the right moves aren’t spending more. They’re spending better.

If 2024 was a year of hesitance, 2025 shows signs of firms being ready to spend. Strategically, of course.

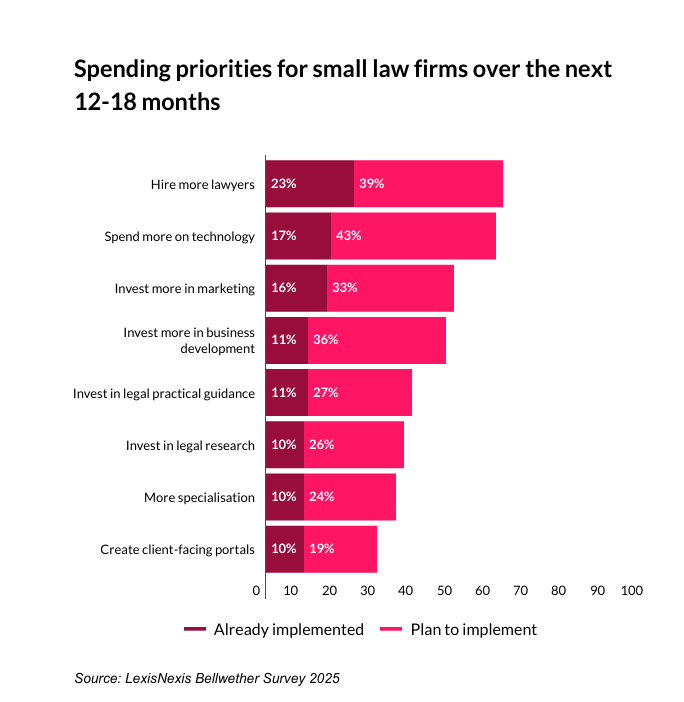

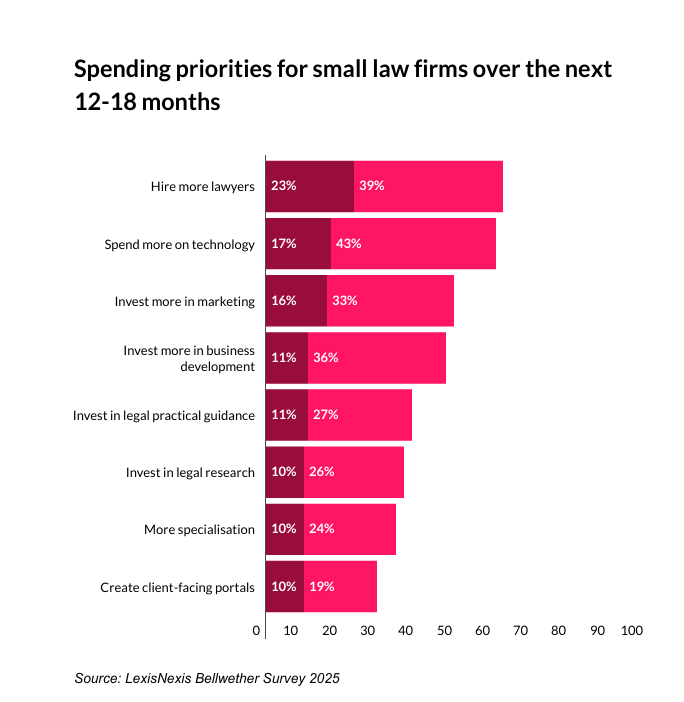

Hiring activity remains steady, with 23% saying they have hired new lawyers in the past year, a noticeable increase since 16% in 2024. A further 39% plan to recruit over the next 12 to 18 months, roughly on par with last year's 40%.

Nearly a quarter (23%) of firms have hired new lawyers

Rayner from LexisNexis says:

"This trend reflects a carefully balanced approach to talent management, prioritising capacity without overextending."

Investment in technology remains steady and strategic. Almost one-fifth (17%) said they have invested more in technology, down from 21% in 2024. Plans to implement have increased from 35% to 43%.

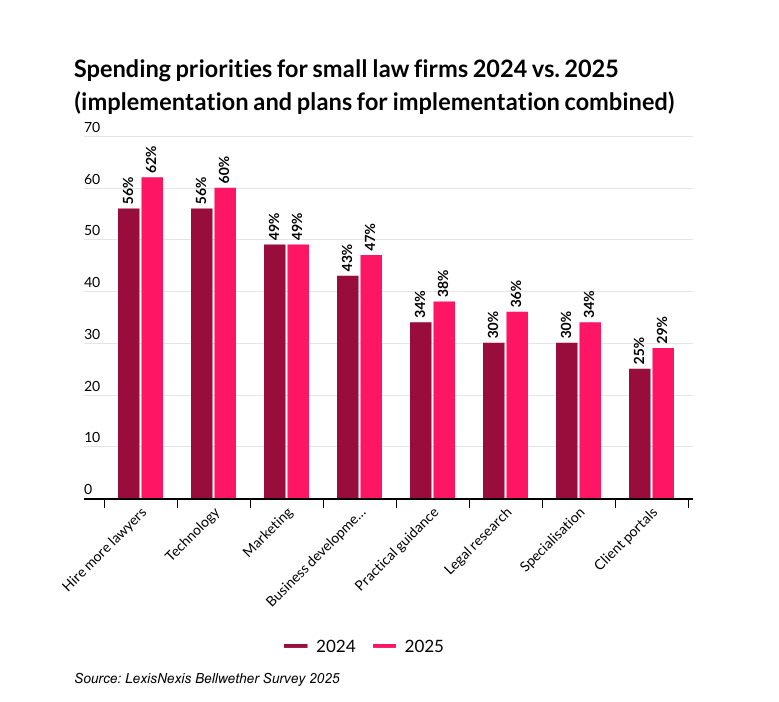

When combining spend with plans to spend, there's small but definitive growth across almost all areas, most notably hiring more lawyers (56% to 62%) and investing in technology (56% to 60%).

This suggests a more staggered investment cycle, where firms are assessing existing tools before committing to new ones, says Rayner.

"There is a sense of deliberate pacing here, a recognition that poorly chosen tech can be as damaging as having none at all," he says.

The same caution applies to marketing and business development. Some firms have already increased their spend in these areas, but instead of acting in the moment, the majority are planning for the future.

Similarly, more firms are beginning to channel funds into legal research, guidance, and specialisation, incremental investments rather than wholesale budget shifts.

These aren’t headline-grabbing moves, but they’re strategic ones, says Rayner.

"The focus has shifted from growth for growth’s sake, to investing in foundations that deliver long-term resilience."

Careful, well-placed investments are giving firms the flexibility they need to strengthen without overstretching.

Meeting expectations starts with the small stuff

Faster replies, clearer pricing, easier access. It’s the small changes that clients remember.

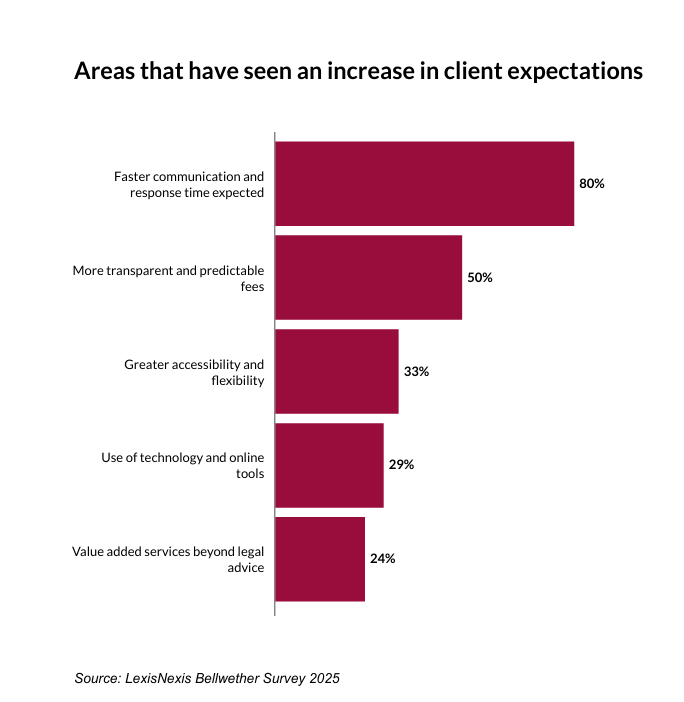

Client expectations are continuing to evolve, and for many small firms, this shift is putting pressure on already stretched teams. The most dominant demand remains response time, with 80% of respondents saying clients now expect faster communication and quicker answers. While that figure has dipped slightly from 83% in 2024, the message is the same: responsiveness isn’t just appreciated, it’s assumed.

Bloom from AFP Bloom says keeping pace with client expectations is exhausting and makes us all prone to mistakes.

"We cannot be everywhere all at once, so we employ people to second us, and then more people to second them. But clients are not satisfied because they want the fee-earner they instructed in the first place."

Being firm with clients about what they should expect is crucial, says Bloom, as is holding them accountable for their own requests.

"If they want a senior team member who is always available, they cannot also pay less. If they want to keep their fees down, then response time will have to give."

Bennett from Arbor Law says: "In a competitive market, responsiveness has become a basic expectation, not a differentiator."

Four-fifths say clients now expect faster communication and quicker answers

But speed is only part of the story. Expectations around transparency and predictability in pricing are rising sharply. Half of all respondents (50%) said clients now want clearer, more upfront fee structures, up from 44% last year. This trend reflects broader economic pressures.

Traditional billable hour models often feel bloated and unpredictable, with clients paying for layers of junior support that add both cost and delay, says Bennett.

"Clients want cost-efficient, transparent pricing and direct access to senior lawyers who understand their business and deliver clarity and pace, not inefficiency disguised as process."

Clients, like law firms, have to cope with many different technologies, an overload of data, and increasing demands from the people they report to, says Giaretta from Fox Williams.

"Some firms are responding to that well by trying to ensure that information is provided to clients in an accessible form, such as a graphic showing spend against budget on a particular job."

Other firms are exacerbating the problem either by providing too much or too little information, he believes.

"Clients want transparency but more than that, they want information in a user-friendly way; and in a way that they can easily package up and pass on to their superiors."

Accessibility and flexibility are also becoming non-negotiable. A third of firms (33%) said clients now expect more options in how and when they engage, a steady increase from 31% in 2024.

One legal associate said, “Clients are increasingly expecting faster, more efficient legal services. AI can automate time-consuming tasks like legal research and document review to help meet these expectations.”

One associate at a small firm said “Clients always should come first, then cost and outcome second.”

Another said:

"The only way to compete in the long run is through client experience. We cannot compete with robots for speed.”

Client expectations are shifting fast, with rising demands for speed, clarity, and flexibility pushing small firms to rethink how they communicate, price, and deliver their services, all while navigating already stretched resources.

Process, people and pricing are under the microscope

Tiny workflow tweaks today could mean big profitability wins tomorrow.

Law firms are grappling with a wave of mounting pressures, from compliance demands to client retention.

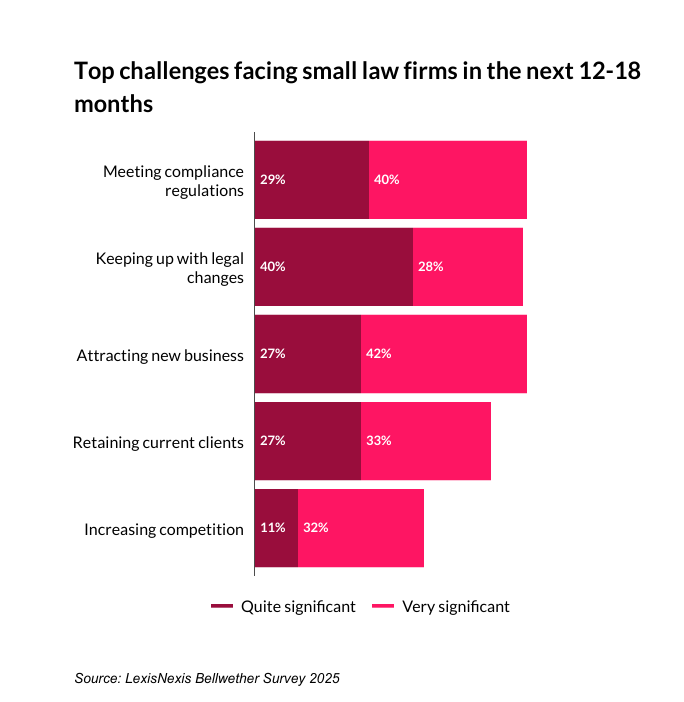

Topping the list of concerns is meeting compliance regulations, flagged as a very significant challenge by nearly 40% of firms, with an additional 29% rating it as quite significant.

Meeting compliance regulations is the top challenge facing small law firms

Staying up to date with legal industry changes also looms large, with over two-thirds (68%) identifying it as a significant challenge, a clear sign that agility and awareness are now critical to survival.

Meanwhile, attracting new business and retaining current clients remain central to firm growth and stability. Around 69% see new business generation as a top concern, while 60% point to retention as a major issue.

When it comes to investment, firms are choosing their battles carefully.

As mentioned, there’s been a modest uptick in recruitment activity.

"This hiring is tactical rather than expansive," says Rayner from LexisNexis.

Technology investment is another area of marginal but meaningful growth. In 2025, 17% said they have already increased their technology spend, while 43% plan to in the near future. This was largely similar to the 21% already invested and 35% planning to invest recorded in 2024.

60% have already increased or plan to increase their technology spend

Marketing and business development are also priorities but in a measured way: 16% reported increasing marketing spend, while 33% revealed plans to do so in the next 12-18 months. One in 10 (11%) said their firm has invested more on business development, with 36% planning further investment. Similar patterns are emerging in legal research (10% already increased spend, 26% planning) and legal guidance (11% already increased, 27% planning).

The legal sector in general is largely reliant on referrals for new work –smaller firms more so.

"We are extremely fortunate that we keep getting new work and work from existing clients without ever having to network or do marketing," says Nicola Grainger of Wains Solicitors.

However, even referral traffic is largely dependent on some prior research from the client – your website, LinkedIn profile, client reviews etc. – to prove your legitimacy.

According to Rayner,

"Rather than major transformation, the story is about small but deliberate investments designed to sharpen competitive edge without overextending resources."

A solo practitioner said the future of legal services will be a high-touch human contact. “Boutique and client-facing is the way forward. Everyone is already fed up with chatbot culture.”

A law firm leader told us “Finding a proper balance of technologies, and ones that work together. Firms are under a lot of pressure as perceived cost savings will be claimed by adapting to these new ideas.”

Tackling small inefficiencies today is the clearest path to protecting profitability tomorrow.

AI is gaining traction, but data use still lags behind

Dabbling in AI is easy, but turning it into a real competitive advantage takes discipline.

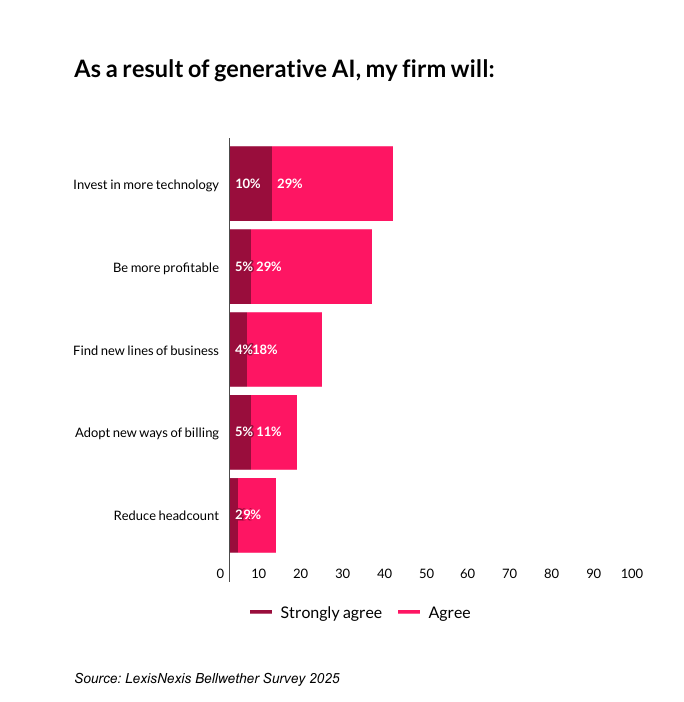

Generative AI’s influence is growing. In 2025, 39% said AI has encouraged their firm to increase their technology investment, up from 33% in 2024. Adoption remains cautious, but the shift signals that firms are beginning to understand AI’s potential to enhance workflows, particularly in areas like legal research and document drafting.

39% said AI has encouraged their firm to increase their technology investment

One solo practitioner says AI should “take the mundane out of the tasks we face.”

One legal associate at a small firm told us they're trialling various offerings, with a focus on security and accuracy.

"AI may speed up certain tasks and provide reassurance to junior team members on accuracy.”

A law firm leader said:

“We use a Case Management System and ChatGPT. Effectiveness is measured on a case-by-case, person-by-person basis.”

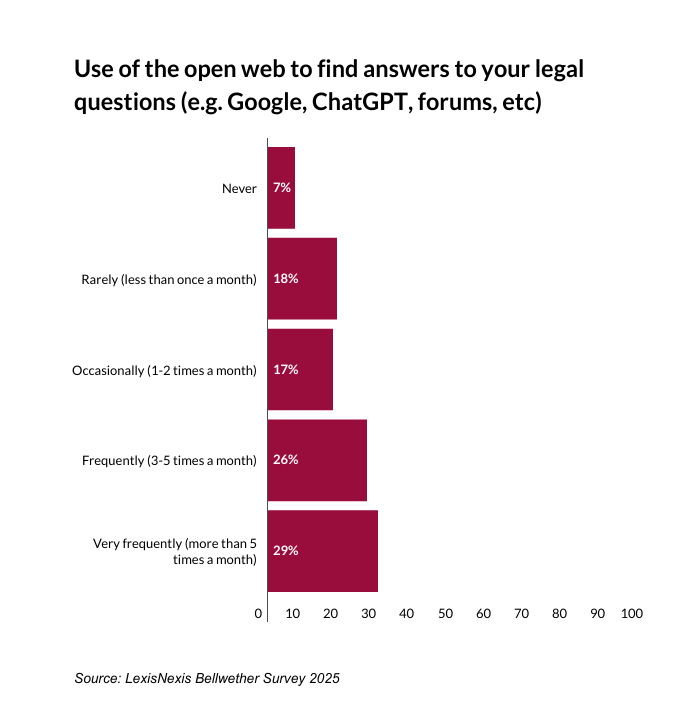

Use of open web tools for research is now widespread: 72% of lawyers said they use Google, legal blogs, AI tools like ChatGPT, or legal forums regularly, either frequently or very frequently. Only 7% said they never use the open web, down from 9% in 2024.

As the use of open web and AI tools becomes more common, the ability to quickly fact-check information against trusted, authoritative sources is essential, says Rayner from LexisNexis.

"Without proper verification, firms risk relying on inaccurate or outdated information, exposing both themselves and their clients to unnecessary risk."

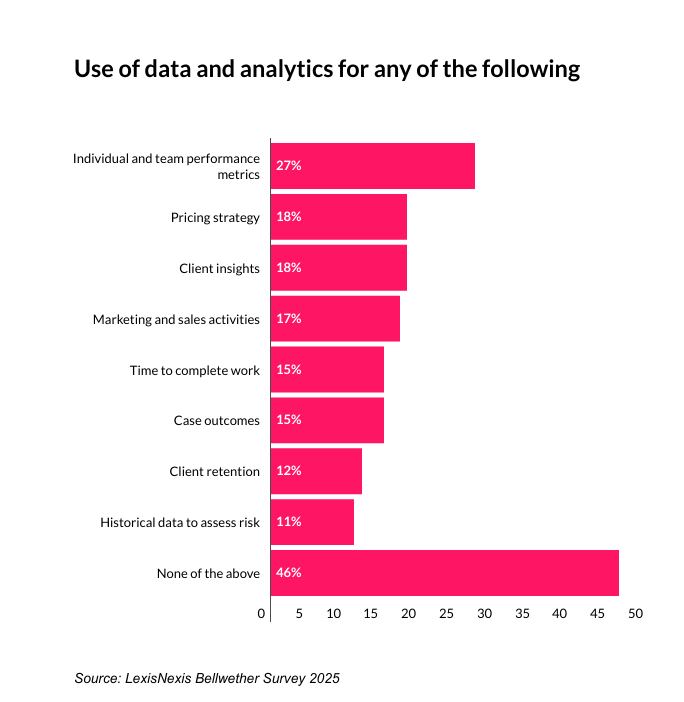

Yet despite increased comfort with new research methods, data and analytics remain underutilised. Almost half (46%) of firms said they do not use data or analytics at all. Of those who do, only 27% use it for tracking individual or team performance, 18% apply it to pricing strategy, and another 18% use it for gathering client insights. Just 11% reported using historical data to assess risk.

Giaretta from Fox Williams says the risk of not using data is that firms lose out on the efficiencies available, and as a result they fall behind their competitors.

But there is an even greater risk from using data badly, or only using part of the data available, he says.

"Firms make bad decisions if they do not see the whole picture."

Firms are investing in new systems, but then they have to persuade their people to use them.

"That requires those people to change their habits, which takes a long time to do."

Many smaller or agile firms are cautious about data and analytics because the use cases are often designed for high-volume, large-firm environments, argues Bennett from Arbor Law.

"The cost of adoption, combined with long contracts and fast-evolving tools, likely makes many firms hesitant to commit prematurely."

Yet without at least some level of data-driven insight, firms risk missing opportunities to sharpen pricing, marketing, or business development, she says.

A legal associate said “We are finding that user experience surveys are valuable for measuring the effectiveness of AI tools. Satisfaction often hinges on the usability, design and integration of the tools.”

Nicola Grainger, a Partner at Wains Solicitors, says they have a dedicated member of staff who deals with analysing data including new work coming in, forecasting and budgeting.

"Some firms tend to be old fashioned and still have one Practice Manager who does not fulfil the same role."

Small firms are exploring new technology, but many are still missing a major opportunity to turn their data into a strategic asset.

What's really holding firms back?

The biggest obstacles aren’t on the outside. They’re in the decisions firms put off.

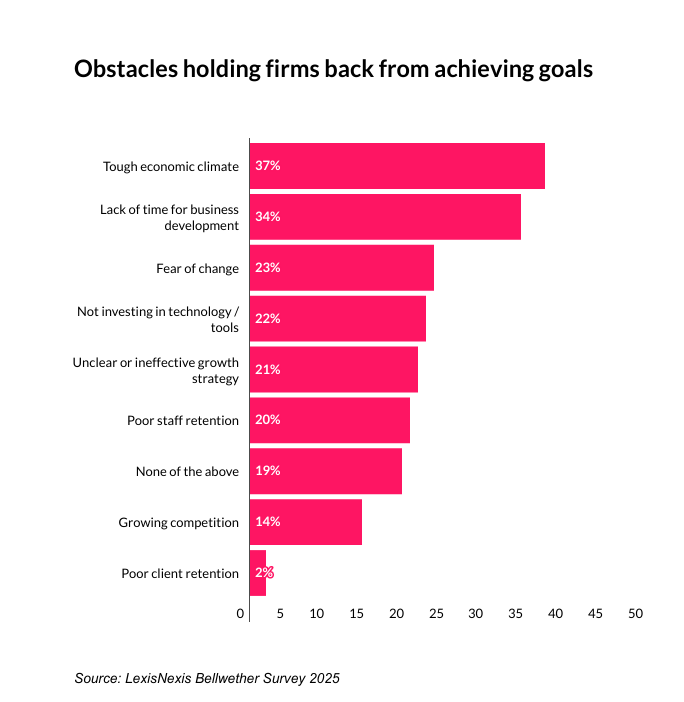

When asked what’s preventing their firm from achieving its goals, the most common barrier was the tough economic climate (37%). Time pressures are also acute: 34% cited a lack of time for business development. Meanwhile, 24% pointed to a fear of change.

The biggest growth barrier is today's tough economic climate (37%).

Fear of change remains a stubborn problem, cited by 18% of respondents. Poor staff retention (16%) and growing competition (14%) were also mentioned, though interestingly, poor client retention was not seen as a major concern, with only 2% flagging it.

The biggest threats, then, are not external disruption, they are internal hesitations: hesitations around investment, time, clarity, and the courage to change.

Marginal gains matter more than ever

This year’s Bellwether findings reinforce a powerful message. Success in the small law sector isn’t about taking huge risks or launching grand transformation projects. It’s about making small, smart, strategic moves, and making them consistently.

Firms that fine-tune their workflows, invest incrementally in tech and people, tighten up their pricing strategies, and embrace data-driven thinking are best positioned to ride out the pressures ahead.

Marginal gains might not make headlines. But they’re the real story behind who survives and who thrives in a tough market.

Survey methodology

The Bellwether 2025 survey, conducted in April 2025, gathered responses from 308 legal professionals across England and Wales. Firms of all sizes were represented, with 26% from practices with five or fewer fee earners, 23% from firms with six to ten, 29% from those with 11 to 20, and the remaining 22% from firms with over 20 fee earners.